PAYROLL 101

Payroll taxes can be a very detailed and confusing part of owning a small business. This is a basic guideline to follow when beginning payroll for your small business.

(more…)TAX DEADLINE 2020: WHAT YOU NEED TO KNOW

In these strange and uncertain times nothing is concrete, not even our tax filing deadlines. On March 11, it was announced that the treasury secretary was working with President Trump to extend the March 16th small business deadline, and also the April 15th individual deadline. On March 17th it was confirmed that individuals could delay payment of their taxes by up to 90 days. The filing of their returns is set to remain April 15th. This includes small business returns as well, with their payment deadline pushed back 90 days from their original March 16th deadline. If you owe on your taxes all interest and penalties will be waived during that 90 day period as long as the return was filed timely.

(more…)7 Accounting Mistakes You Could be Making as a Small Business Owner

Thanks to the improvements in the realm of DIY bookkeeping and accounting software, it is getting “easier” than ever for owners to handle their small business bookkeeping on their own. But is it really easier?

(more…)PERSONAL DEDUCTIONS IN 2020

Our tax code is often a confusing jumble to rules and percentages. It’s hard to tell if something is tax deductible or not without some advanced knowledge of tax. And of course, they change things up on us all the time. We at Watkins and Company have gathered a list of some of the lesser known deductions that can be taken for your 2019 taxes

(more…)Is it Time to Hire a Bookkeeper??

We hear it often in our Industry “I wish I had hired you guys sooner!” but how do you know when it’s the right time to transition from doing your books on your own to hiring an accounting firm? There are some major benefits to hiring an accounting firm with bookkeeping services:

(more…)Do I need to send 1099’s? Nine Things you need to know as a small business owner

The 1099 Process can seem a bit daunting, but don’t let it overwhelm you. Here are nine basics that you need to know about 1099s

(more…)Two New Mississippi Tax Credits You Need to Know About

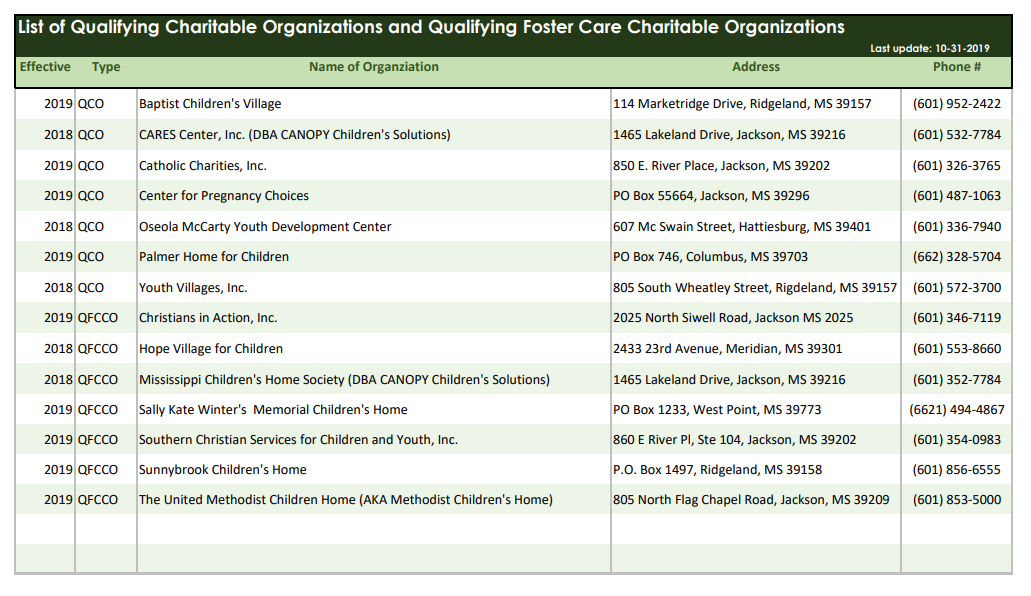

There are two new Mississippi tax credits available to individuals who are interested in donating to charity, with the added benefit of a dollar for dollar tax credit.

A Married Filing Joint taxpayer, with an AGI of at least $100,000, can receive up to an $800 credit for a QCO donation and $1,000 credit for a QFCCO donation for a total of $1,800 in tax credits. The list of eligible charities is below:

(more…)New Tax Law: Taking Advantage as a Small Business

Every year, new tax laws and IRS regulations change, sometimes mildly and other times, quite dramatically. However, the TCJA (Tax Cuts and Jobs Act) out paces any recent changes to tax legislation by a long shot. Since much of the new legislation will be in affect for 2018 taxes, it is important for all small businesses to take advantage of this new information. Here are some important changes and advantages that small businesses should consider ahead of preparing their 2018 tax return in accordance with the new tax law.

(more…)Is “BOGO” a “NONO”?

Sales Tax for Special Promotions

Have you ever reaped the benefits of offering discounts, promo codes, and coupon deals? If so, you understand the power it has to draw customers new and old in droves. What you should also understand, is that states expect you to know how to handle the sales tax for those different types of purchases.

With few exceptions, sales tax is the gross receipts or gross selling price received from selling products or offering taxable services. Seems simple enough right? Yet, retailers are often stung for mishandling the taxes charged with these purchases.

PAYROLL-PROVIDER-MADISON-MS

NEW SMALL BUSINESS SUCCESS ITINERARY

Itinerary for New Business Startup

The time it takes for a new business startup to get up and running is best described as a journey. The end of the trip may not be visible or even feasible at the start-ups beginning, and owners will surely experience difficulties along the way. Fortunately, developing a working relationship with a trusted accountant will supply guidance towards successfully reaching business owners’ goals.

Watkins took one of the biggest headaches in my business and made it simple! Excellent, consistent results.

-Travis – Brandon Mississippi

You must be logged in to post a comment.